Winners and Losers from 2024 – In the Financial Markets and at Gevers Wealth Management

2024 brought positive returns for many investors, but not without its challenges and uncertainty for stretches. Turmoil from the presidential election cycle, a boom in the AI industry, a burgeoning Federal deficit, and wild swings in the interest rates all had their time in the spotlight, but investors who stayed true to their strategies and weathered the turmoil were rewarded as most major investment types finished the year positive.

It’s time to look at who the biggest winners and losers in the financial markets were in 2024, and we’ll end with some memorable events at our company, with plenty of pictures. (Starting on page 5 if you want to skip the financial commentary)

Let’s get started!

In the Financial Markets

Winners

Stocks

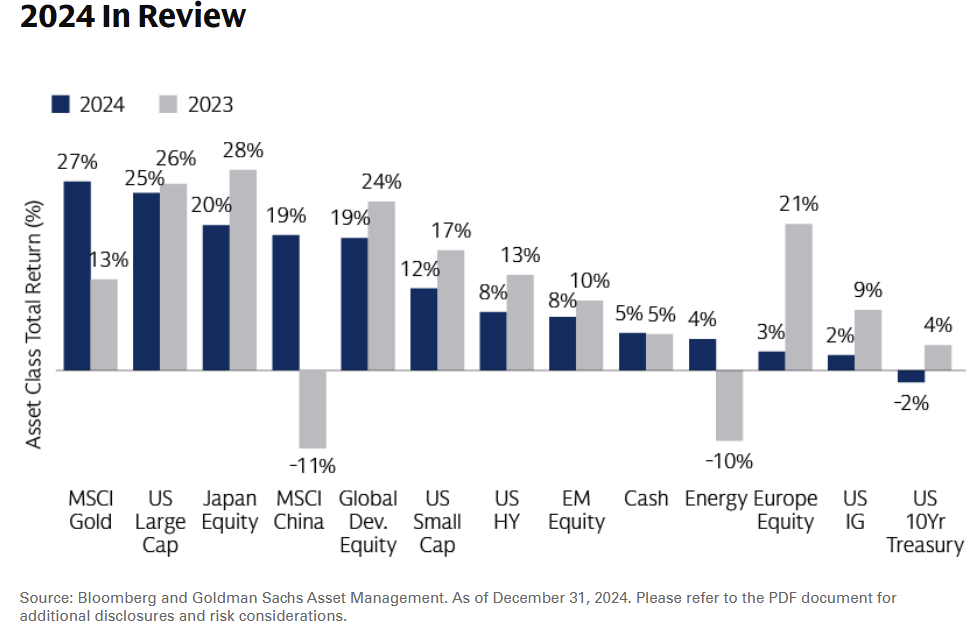

Investors saw above average returns in the stock market across almost every category. Indexes tracking the returns of small, medium, and large companies in the US saw double digit returns. The international market was more divided with some countries like Japan (Up 20%) doing very well, while Europe lagged (Up 3%).

Gold

Gold was the top performing major investment category of 2024. Up 27%, it had a stellar year as fears over excessive money printing and debt creation pushed the safe-haven investment to new highs.

Fed's Strategic Rate Cuts

In response to slowing economic growth and stable inflation, the Federal Reserve cut the benchmark rate by 50 basis points on September 18, followed by a 25 basis point reduction on November 7, with another 25 basis point cut in December. These first cuts since March 2020 aim to stimulate economic activity by lowering borrowing costs. The market is closely watching future Fed actions and their economic impact in 2025.

Values Based and ESG-focused investing

Investments with screens for investor values are continuing to grow rapidly. In 2024, the assets of ESG funds under management exceeded $3.2 trillion, 20% more than last year. Value screens give investors the option to invest along with their beliefs including environmental, social, and faith based option. This includes projects like more than $450 billion that have been invested in renewable energy, such as solar, wind, and hydrogen in 2024.

Best Performing Stock: Palantir (Up 340%)

The best performing stock in the SP 500 in 2024 was Palantir. A technology company that gathers and analyzes data, they were perfectly situated to capitalize off the AI revolution. Starting the year with a stock price still beaten down since 2022, they had plenty of upside potential and were added to the SP 500 part way through the year. Other companies in consideration: Vistra up 258%, Nvidia up 171%, United Airlines up 130%.

Losers

Long-term Bonds

Long-term bonds continued their trend of poor performance. Though not down a lot, only -2% at year-end, long-term bonds were the only major asset class to be negative in 2024. Rising interest rates at the long end of the yield curve continued to hurt their performance.

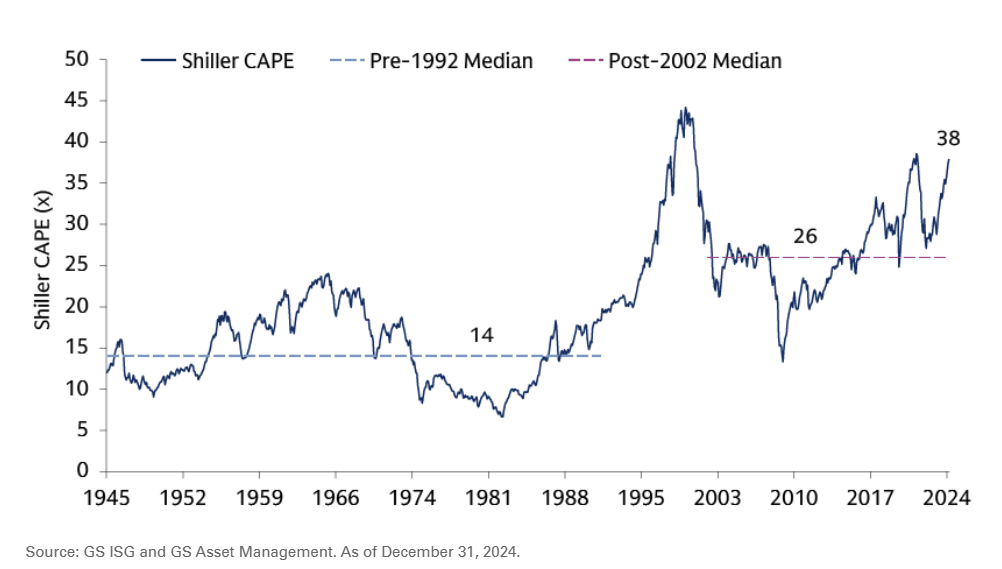

Valuations

Stock valuation metrics help investors assess the relative value of an investment and can serve as a warning of bubble conditions in the investment markets. Currently stock valuations are much higher than their recent average and have only reached this level two other times in history. High valuations do not guarantee a downturn is imminent, but it are a good reminder to assess the risk level and stock sensitivity of your portfolio.

Tariffs and Trade Wars

President Trump was already discussing tariffs early in his campaign trail, and it didn’t take long for the first wave to be implemented. The hope is they are being used as a negotiating tactic, like in his first term, and not a long-term move away from free trade, but even the short-term tariffs from Trump’s first term caused several months of volatility and bad markets. No one is a winner in a trade war. (Read our newsletter about the 2018 trade war.)

Worst Performing Stock: Walgreens Boots Alliance (Down 64%)

Walgreens Boots was the worst performing stock in the SP 500 in 2024. They started the year with the goal of being the go-to provider for basic health needs but fell far short and were passed by many major competitors like Walmart, Target, and Costco. As a result, they were dropped from the Dow Jones Industrial Average, further damaging their stock price. Other companies in consideration: Intel down 60%, Moderna down 58%.

At Gevers Wealth Management Winners

Happy Parents Trey and Nicole

Trey and Nicole welcomed a new baby to their family, Cameron Scott Gevers! They are doing great as new parents and just took Cameron on his vacation to Hawaii.

Happy Grandparents Willy and Vivienne

Willy and Vivienne are overjoyed with their new role as Cameron’s grandparents. It’s safe to say Christmases just got a lot more fun at the Gevers’ household.

Andrea’s Wedding

Andrea, our new director of client operations, got married to her husband Jim this September at the beautiful Columbia Gorge.

Katie and Garrett’s Post-Engagement Trip

Garrett and his fiancé Katie were able to go on an amazing trip to Europe this summer. Starting on the Amalfi coast with a tour of Pompeii, they continued to Greece, stopping in Santorini, the island of Naxos, and ending off in Athens. It was an amazing trip, and they are very grateful for the time spent together.

Volunteer Positions

Willy continues his position as a board member and the treasurer of Stronger Families, who work to strengthen the families of military members and first responders. Our whole team attended their annual fundraising gala this year which was a blast!

Garrett has taken on a new role as vice president for the CFA Society of Seattle. They continue to work to promote professional excellence, education, and ethical behavior in the local investment community.

Even with a new baby, Trey continues to volunteer with high schoolers as a part of YoungLife.

Closing Notes

It has been an honor to serve all our clients in 2024, and we were blessed to see the positive impact prudent investing and planning has had for them and their families. We stay committed to your financial success and look forward to the coming year and both the opportunities and challenges it will bring with it.

Happy belated New Year!

Your team at Gevers Wealth Management