Looking Forward-Potential Investment & Tax Opportunities with President Trump

Fall 2024

Went fishing a couple of days before the election. Floated the Yakima River with a couple of friends on a cold crisp fall day. We had the river to ourselves, probably because the temperatures had dipped to the 20’s in the morning. The trout were lethargic in the cold weather, and we worked hard to find fish, rowing miles of the river in my drift boat.

A few hours after lunch we found what we had been so intently looking for. A pod of trout was actively feeding in a long slick stretch. With singular focus, we carefully presented our tiny flies. If we did so with the proper technique and strategy, we were rewarded with the smack of a large native rainbow trout gulping our tiny mayfly imitation. It was great fun, and the joy of catching those fish was a fitting reward for our efforts and focus.

I have been singularly obsessed with both fly-fishing and finance my entire adult life (I like to say that my life is based on the “Five F’s” Faith/Family/Fitness/Finance/Flyfishing!)

It occurred to me that my team and I are as intently focused on searching for tax and investment strategies to help make our clients’ lives better, as my friends and I did for searching for trout that chilly fall day.

With a new president taking the reins in a few weeks, there may be some options to improve our financial lives with investment opportunities and tax strategies. Let’s focus on some of the changes that President Trump might bring about that might benefit our investment portfolios and reduce our tax bill. (I would also add that with new leadership, there is uncertainty and worries also, and there are many people that are quite concerned about the new administration. Let’s also examine some of those concerns and what they might mean to our portfolios.)

Investment Opportunities:

Energy: Trump’s platform proclaims, “Make America the Dominant Energy Producer in the World, by far!” This US-centric policy bodes well for US oil & gas producers and energy companies. During Trump’s first term we enjoyed low gasoline and oil prices due to these policies, and these low prices in turn increased consumer’s discretionary spending, helped make many companies more profitable, and helped keep inflation low. If we have a repeat of the successful energy policy of the first term, we may enjoy these benefits again.

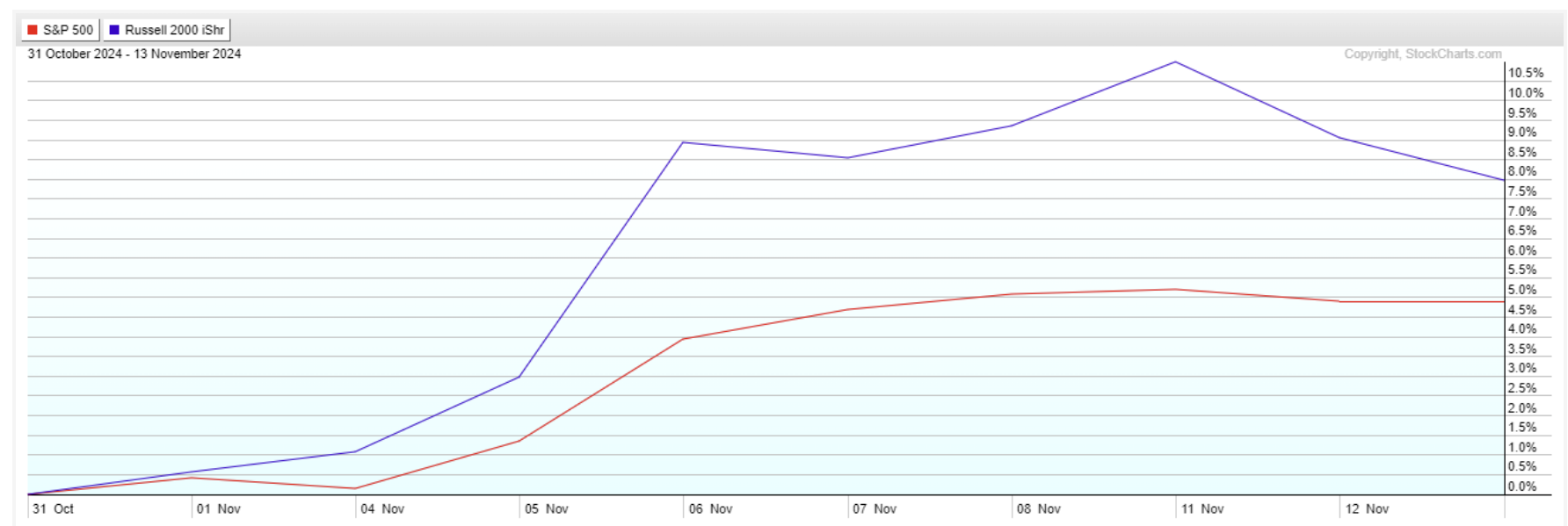

Small Companies: Trump championed a streamlined regulatory environment in his first term, which resulted in an almost unprecedented level of optimism on the part of the small business community. Smaller companies struggle more with regulatory burdens than large companies because of their smaller size and limited resources, and thus streamlined regulations might give them a great benefit. Additionally, smaller stocks have a history of performing well after an election. The stock market seems to recognize this, as the US small company stock index jumped about ten percent in the week of the election, far out gunning the still outstanding 5% increase in large company stock prices.

(Small company stock index jumped rapidly after the election!) StockCharts.com

Investors may want to check smaller company exposure in their portfolios to try and take advantage if this trend continues.

US Manufacturing & Tariffs: The Trump/Vance platform says, “Stop Outsourcing and turn the United States into a Manufacturing Superpower.” Again, this US centric policy seems quite favorable both for US job creation and for the profitability of US based companies and the economic infrastructure that supports domestic manufacturing. Trump has also said that he plans to enact tariffs on foreign made goods as part of this directive. Many US companies could prosper in that environment.

Investors may want to review their portfolio’s participation in this potential trend.

Bitcoin & Blockchain: Number 13 in the Trump agenda is, “Keep the U.S. Dollar as the World's Reserve Currency.” Trump has stated his opposition to a Central Bank Digital Currency (CBDC), and has been an enthusiast for Bitcoin, even suggesting adding BTC to the US strategic reserves. In addition, one of the staunchest enemies of BTC and the chair of the Senate Banking Committee, Senator Sherrod Brown, lost his re-election bid, and was voted out. It is anticipated that he will be replaced as chairman by a senator that is more friendly to crypto.

Along with all of that, Trump inherits a massive federal deficit that also drives continued interest in BTC as a hedge to the USD. Forbes said recently,

“The growing concerns in the U.S. and abroad over the state of U.S. federal deficits and debt has increased the appeal of potential alternative reserve assets (like BTC) as a potential hedge against possible future events affecting the U.S. dollar."

As a result, BTC price soared in the week of the election, and the price hit all-time highs.

(A note about BTC – this is an extremely volatile asset and takes huge price swings both up and down. It has some unusual risks and as a result is even riskier than stocks. We do not have BTC in our portfolios, but have been watching it with interest. Only a handful of our more adventurous clients actually own it. This is not advice or a recommendation to own BTC.)

Investment Concerns:

It goes without saying that President Trump is very unpopular with a significant portion of the US. Our job as advisors is to be relatively agnostic as to politics and focus on potential impacts, both positive and negative, that might impact the markets and our portfolios. Here are a few concerns with the new president.

Tariffs: Trump has stated his plan to enact tariffs on foreign goods sold in the US. While this is not new, and in fact has been a policy tool for many years, what he seems to be suggesting is at a magnitude greater than currently exists. It’s not clear what impact that might have, but many economists are not enthusiastic about the idea. (but remember that economists are notoriously bad at predicting the future…)

One plausible scenario is that widespread & higher tariffs could boost inflation. This is concerning because inflation is often bad for stock returns and awful for bonds, as we experienced in 2022. It is difficult to actually enact a policy change of that magnitude and perhaps what actually happens is more diluted, and less dramatic than what has been discussed during the election. We will wait and see how this plays out in real life.

Deficit: Trump is inheriting an enormous deficit, as noted above. I have written about the US debt, the deficit and Fed policies in previous newsletters. This should be an issue of great concern to all US citizens. During Trump’s previous term, both his and the Federal Reserve policy has been generally looser monetary policy which is friendly to asset prices like stocks & real estate. However, there are many unknowns here and future negative ramifications from our enormous debt is a possibility.

First Year Blues: The first year of a new president is often a poor one as far as stock returns go. The historical average of the US stock market is far below average for the first year. Some have suggested that is because of the uncertainty surrounding new policies from a new president. That could well be the case in 2025 as Trump’s policies will be dramatically different than his predecessor.

We will be dealing with this uncertainty and concerns with the same steadfast investment principles that have worked through the decades; diversify prudently and well, rebalance on a regular basis, anticipate your income needs ahead of time, have appropriate liquidity, and be a patient long-term investor.

However, in general Trump’s policies were very friendly for the stock market during his first term, and investors seem to be anticipating that happening again during his second term. One of our long-time dear clients, who has never voted for Trump and does not like him, told me during his first term, “Of course the markets are doing well, he is a businessman after all.” Maybe she has a point!

Tax Planning:

The Trump/Vance platform item #6 “Large tax cuts for workers.” During Trump’s first term, his signature tax bill, the Tax Cut & Jobs Act (TJCA) was passed into law and gave many Americans significant income tax savings. Many experts expect dramatic changes in the tax code during his second term, including:

Extension of the TJCA: The TJCA is scheduled to expire at the end of 2025, at which time tax rates will revert back to the previous higher rates. Most observers expect that the TJCA will be extended, which means that a taxpayer may have another ten years of a lower income tax rate regime.

This lends itself to continued use of Roth Conversions inside of these lower tax brackets, and “back-door” and “Mega backdoor” conversions to try and maximize the use of tax-free Roth accounts for high income investors.

Anyone with significant balances in IRA and/or 401(k) plans should be working with a skilled tax planner to take advantage of a possible extension of the TJCA.

Increase in SALT: One change that was painful to folks with expensive homes is the limitation of property tax deductions to only $10k. As home prices have skyrocketed since 2016, more and more homeowners are feeling the pinch of the SALT limitations. There has been much discussion about a change that will be more friendly to families with very valuable homes.

Corporate Tax Rates & QBI Section 199A deduction: A reduction in corporate tax rates, and possible expansion of the QBI for small business owners could be fuel on the fire for the business community- both small business owners as well as large corporations. Lower corporate tax rates can lead to higher corporate profits which often pushes stock prices and business valuations higher.

If you own a small business, you will want to watch these possible changes carefully to see if you might benefit.

Estate Tax Exemption: The estate tax threshold is scheduled to drop drastically at the end of 2025, if TJCA is allowed to expire. Successful families have been scrambling to position their assets to try and avoid a crushing tax bill that accompanies lower exemption amounts. If TJCA is extended, higher net worth families might have an extra ten years to implement strategies to reduce the tax bill families might have to pay when they transfer assets to their children.

If the value of your assets is high enough to incur an estate tax liability, you may want to work with a skilled tax-planner to take advantage of possible extension of the TJCA.

Qualified Opportunity Zone (QOZ): One of the more popular provisions passed during the first Trump administration was the QOZ. This program was a boon for developers, helped increase development in less privileged communities, and offered significant capital gains deferrals and tax forgiveness for investors. QOZ are scheduled to expire in a year, but there has been talk of also extending this program.

If you have or will be experiencing a significant liquidity event with a large capital gain (e.g. sale of company stock, sale of a business, exercise of Qualified Stock Options, sale of a property) You may want to watch for a rule change regarding QOZ and consult a skilled tax planner to see if this might be a suitable strategy for you.

Rebalancing & Spending:

When the markets reach all-time highs, it is always a good idea to review your spending and income needs. Portfolios are sitting on substantial gains since the last market downturn in 2022. If you have major expenses coming up, and/or you have income needs in 2025, this could be a great time to take a distribution from your portfolio. We have been encouraging clients to take advantage of great returns to buy new cars, pay for vacations, gifting to family, or just increase their cash reserves.

Also, with the dramatic recent jump in prices across many investment sectors, we are rebalancing portfolios as necessary. A robust and regular rebalancing protocol can help enhance returns and keep risk at appropriate levels.

We can discuss your income needs and rebalancing strategy at our next review meeting, or as always please feel free to call us if you would like to discuss any of these topics before your next scheduled appointment.

A Personal Note: This has been the most emotional and polarizing election of my lifetime. We respect our client’s personal feelings.

We value relationships with people far more than politics.

We have the privilege and joy of working with a lot of wonderful families, and we never forget that our job is to try and make their financial lives better.

From a professional perspective, our team’s job is to evaluate the election results and try and discern if and how our client’s investment portfolios & tax strategies can benefit under the new leadership.

We live in an amazing country full of opportunity and I am hopeful and optimistic for the United States in 2025 and beyond. Looking forward to seeing you at our next meeting.

Hope you had a wonderful Thanksgiving filled with family, friends & food. We enjoyed free-range turkeys from our friends & clients at Soggy Bottom Farms! Pictured is the brother of our feast fowls 😊

Warm Regards,

Willy

William R. Gevers CPWA®

Financial Advisor/President

PS: We have been repeatedly asked by clients if they could share these e-mail notes with their friends or neighbors. Please feel free to forward this with the stipulation that it may only be forwarded if done so in its entirety with no portions omitted. We would be delighted to share our comments and opinions with your friends and welcome your comments and feedback. If you received this and would like to be included on our newsletter list, please email us at info@geverswealth.com

Copyright 2024 William R. Gevers. All rights reserved.

Did you enjoy this newsletter? Please like us on LinkedIn! https://www.linkedin.com/in/willy-gevers-cpwa%C2%AE-71ab154/

Gevers Wealth Management, LLC

5825 221st Place SE, Suite 102

Issaquah, WA 98027

Office: 425.902.4840

Fax: 425.902.4841

Email: info@geverswealth.com

Website: www.geverswealth.com

The views are those of Gevers Wealth Management, LLC, and should not be construed as individual investment advice. All information is believed to be from reliable sources; however, no representation is made as to its completeness or accuracy. All economic and performance information is historical and not indicative of future results. Investors cannot invest directly in an index. Please consult your financial advisor for more information. This material is designed to provide accurate and authoritative information on the subjects covered. It is not, however, intended to provide specific legal, tax, or other professional advice. For specific professional assistance, the services of an appropriate professional should be sought. Past performance is not indicative of future results. All investing involves risk, including the potential for loss. No strategy can ensure a profit or protect against loss in a declining market. Securities and advisory services offered through Cetera Advisor Networks LLC Member FINRA/SIPC a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from an any other named entity. Cetera does not any direct investments, endoresments, or advice as it relates to Bitcoin or any crypto currency. This is for informational purposes. A diversified portfolio does not assure a profit or protect against a loss in a declining market. Rebalancing may be a taxable event. Before you take any specific action be sure to consult with your tax professional.